The Mistake

Here’s something you can stop doing if you’re doing it: Weighting your stock market exposure based on dividends. It’s not the thing. It may work in one particular type of market but it doesn’t beat the market most of the time. It certainly won’t beat the market over long periods of time. It doesn’t matter what version of a dividend strategy you employ. High dividend, Dividend Aristocrats, dividend growth, new dividends, yield targeting, Dogs of the Dow - it’s fine, but it’s not the thing.

Imagine buying a portfolio of houses for investment purposes but telling the realtor who’s out looking for properties that you mainly want to focus on the garages. “Don’t worry so much about the house, just get me the ones with the largest garage.” They’d look at you like you’re crazy. Nobody’s against a good garage. But the presence of a garage is not going to determine whether or not owning the house becomes a good or a bad investment.

In the same way, dividends are fine. They may represent management confidence in future cash flow generation, they may serve as a marker of stability, they may indicate the maturity of the business. And the payments are nice. I love seeing my dividends roll in. But that’s not the same thing as I want to buy a stock because of its dividend. It’s just a feature of the equity. Like earnings, revenue growth, management team, market share, brand value, competitive moat, whether or not the industry is in favor, new product launches, the potential for M&A, the authorized share repurchase plan, etc. These are all features. Dividends are a feature. A positive feature usually, but just one of many that determine the future success of a stock.

But sometimes dividends get cut - especially if they’re too high relative to what the company can actually afford to pay. Sometimes The Street doesn’t care how solid or supported by fundamentals a dividend is, they just don’t want to own the stock. You’ll find many high dividend payers in industries that are currently under siege from competitive threats and obsolescence risk. My first year in the industry we were selling Bethlehem Steel shares to our clients. It had a market-leading dividend. Until it had to cut that dividend to stay out of bankruptcy. Spoiler: Didn’t work. The dividend wasn’t high because the company was being generous. It was high because the stock price had collapsed and the investor relations people were probably telling management “Whatever you do, don’t cut the dividend, that’s really going to scare people.” In hindsight, they should have been less worried about stock market optics and more worried about how they were going to survive as a business. Beth Steel’s old mill is now a casino.

True story:

SteelStacks cultural center, part of the Sands casino redevelopment agreement

This is a worst-case scenario, of course, but optimizing for high yields and nominally large dividend payouts will get you into these situations. After the steel stock fiasco, we spent a big chunk of the 2000’s decade selling people shipping stocks. These were tanker and drybulk vessels owned by Greek shipping magnates and their sons and grandsons with publicly traded tickers and insanely high payouts of 10, 12 and even 14 percent yields. Only those yields were vapor when push came to shove. These businesses had insane amounts of debt and extremely high operating costs. They’d pay out for three quarters and then cut the dividend either partially or entirely because of this storm or that commodity crashing or maybe a pirate attack or collision in some faraway gulf. And then the stock would tank (pun intended) into the single digits never to be heard from again.

Why were we selling these stocks to people? It’s what they wanted to buy. When you say 14 percent yield to the right kind of person, they say yes. “Is the dividend safe?” the only thing you could say is “for now.”

And sometimes a stock has a high dividend because there’s no growth at the company and it’s the best thing the board can think of to do. Maybe it’s a fundamentally sound business, but there’s no growth possible and the dividend becomes the only feature of the equity worth paying attention to. Does this sound like the type of company that’s going to produce strong returns in the future?

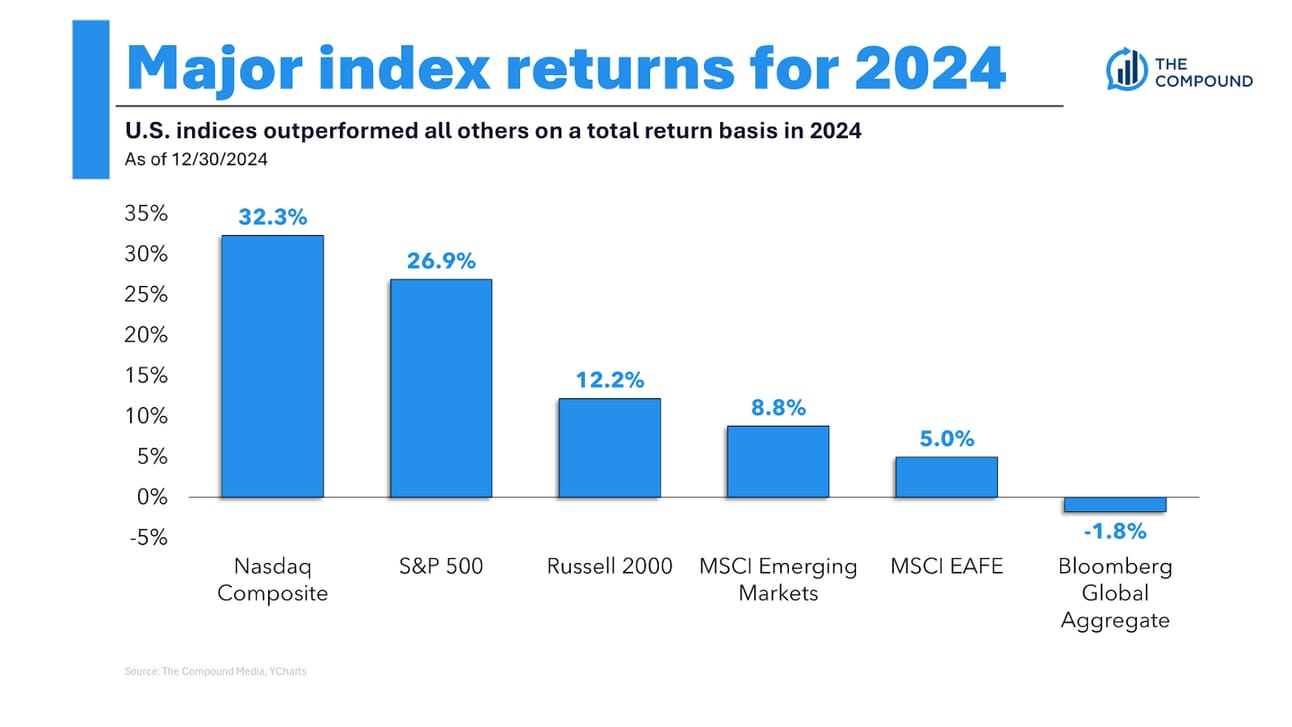

Here’s how the stock market did in 2024 via Chart Kid Matt:

A portfolio weighted toward the dividend factor did atrociously in comparison, among the worst factors you could have weighted toward:

“But Josh, you’re cherry-picking. That’s just one year!”

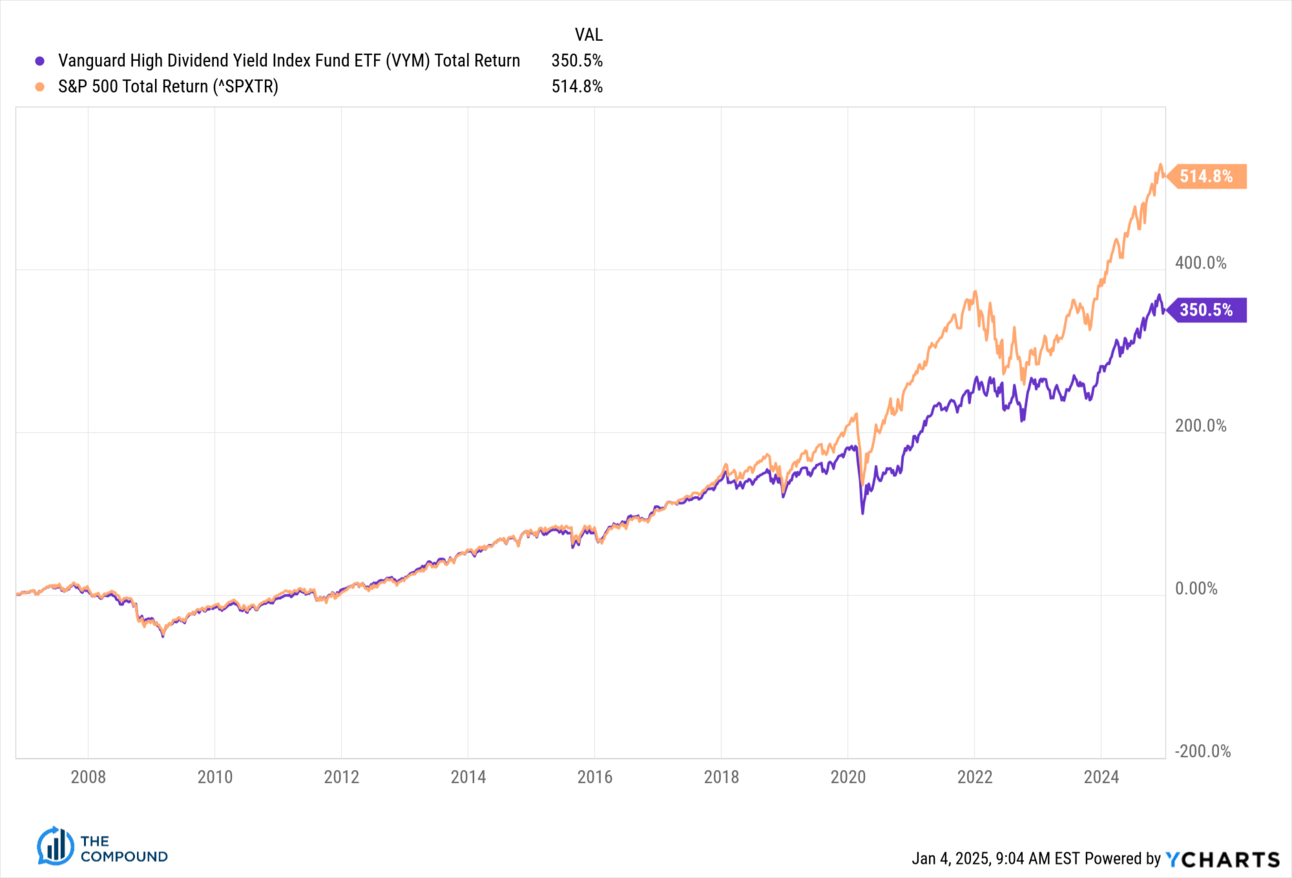

True. So here’s twenty years or so of the Vanguard High Dividend Yield Index Fund ETF (total return) vs the S&P 500 index, would you rather have the orange line or the purple line?

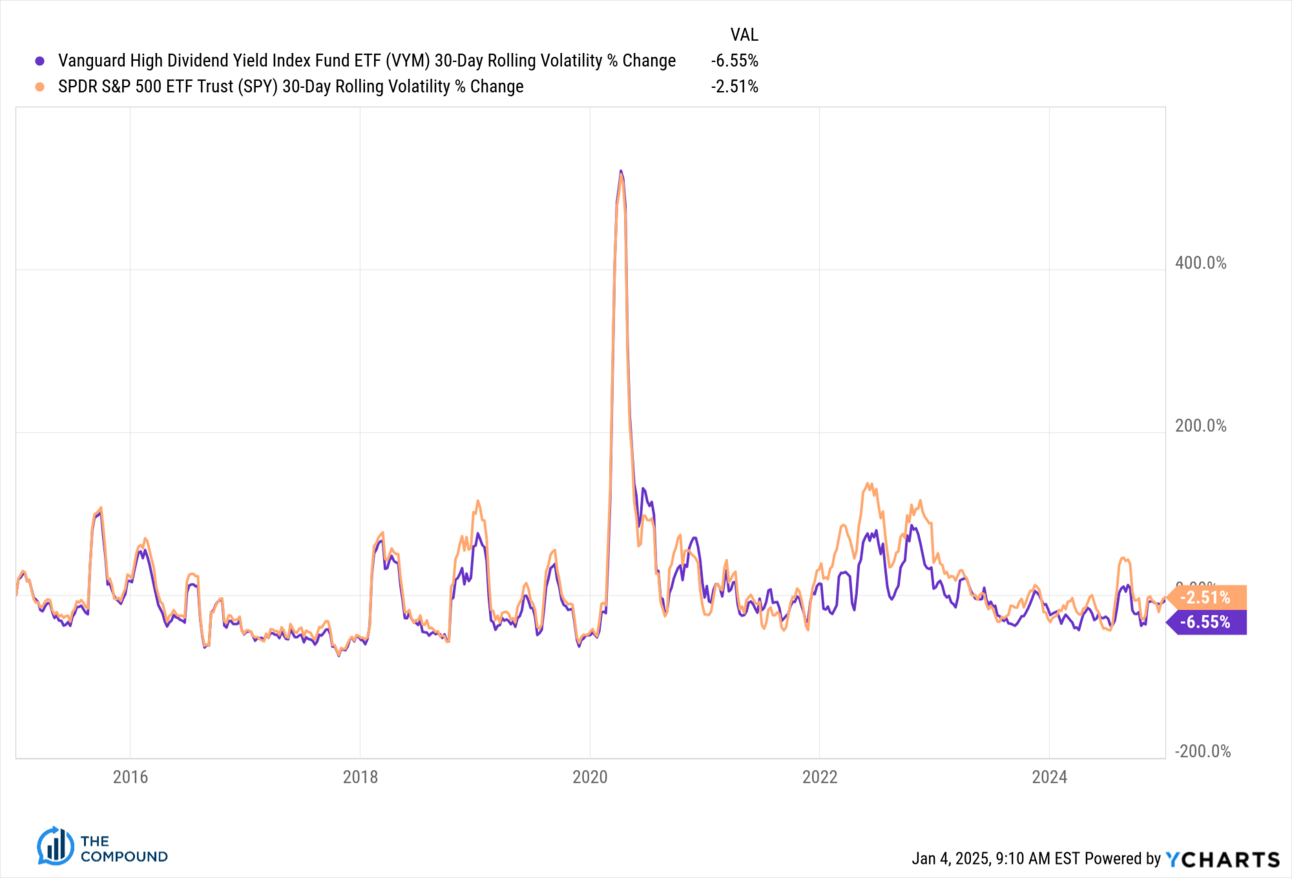

“But wait,” you’re probably saying now - “What about risk-adjusted returns? Surely the volatility of the S&P 500 has been higher than the volatility of the high dividend index, right?” The answer is yes, sometimes. Sometimes not.

Among the biggest dividend payers leading up to the financial crisis were banks, mortgage companies and homebuilders. Do you think that was a low volatility experience? Oil companies have also been historically high weights in these dividend indices. Do you think owning oil stocks over the last ten years has been a low volatility experience?

Here’s the 30-day rolling volatility for Vanguard’s high dividend ETF vs the volatility of the S&P 500 SPDR ETF:

I promise you that the difference in volatility on a day to day basis was not enough, in the moment, to have been distinguishable for the holder of these stocks. Believe me, when push came to shove, you felt the vol every bit as much as you would have with a market-cap weighted index approach. Maybe the yield made you feel better because you could see the cash come into your account. Fine, stipulated. But again, with the benefit of hindsight, those higher payouts now serve as cold comfort given the massive underperformance you’ve experienced vs the major averages.

And besides, since when was avoiding day to day volatility the point of equity investing? Did I miss a webinar about this?

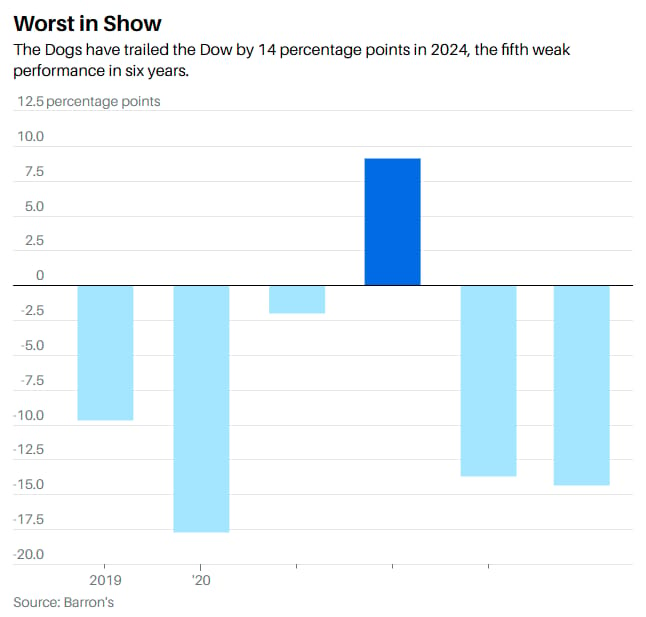

Lastly, allow me to show you the performance of the famous Dogs of the Dow strategy, in which the investor goes long the ten Dow Jones Industrial Average stocks with the highest dividend yields…it’s only outperformed once in six years during the maelstrom that was 2022:

And of course, last year it was the dog that barked the loudest. The theory behind this strategy is that a high-yielding stock in the Dow probably just came off of a difficult year with a falling share price, which is how the dividend became high in the first place, which means it’s a good bet for future gains thanks to the magic of mean reversion. Good theory. Terrible investing philosophy in practice. Don’t do this.

Why are there dividend strategies in the first place?

So now you’re probably wondering why people pursue high dividend strategies in the first place, given the degree to which they’ve failed to keep pace with the post-financial crisis bull market. Great question. I will tell you some of the things I hear people say:

“My clients are older and they prize current income above higher returns.”

“Dividends are more reliable than revenue growth or innovation.”

“I’d rather use the money from dividends to withdraw and live off of as opposed to having to sell a chunk of my stocks each year to pay my bills.”

“Dividends are better than buybacks because, even though they’re both the same thing, with dividends I can see the cash hitting my account.”

“Dividends are higher quality companies.”

Here are my responses:

“Plenty of formerly high quality companies pay steady dividends on their way to becoming low quality companies.”

“Dividends represent double taxation in a way buybacks do not - first the company is taxed on the income it earns and then you, the investor, are taxed on the dividend income. The buyback excise tax that was initiated under Biden is a tiny rounding error in comparison.”

“The role of a financial planner is to optimize withdrawals for retired investors, not to make them feel better that none of those withdrawals are coming from principal. Giving good advice means telling people why their instinct is wrong, not feeding into their wrong ideas for the sake of getting them to say yes.”

“Dividends are good, but total return is what matters most. Focusing predominantly on dividends means giving up a lot of the upside of what the stock market has to offer. Some of the biggest winning stocks in history didn’t start paying dividends until much later in their growth phase, if at all.”

Dividends are great. So are capital gains. The returns of the stock market come from earnings and revenue growth, dividend payouts, buybacks that shrink the float and many other factors. Why pick one to obsess over? Because it looks good hitting your account? Because it makes you feel better? Looking good and feeling better are not the route to great performance. Being uncomfortable at times and embracing risk for the long term - this is the way it’s done.

Frequently Asked Questions

And now, to pre-empt any misunderstanding about what I’m saying (and what I’m not saying), a brief FAQ:

Should I own dividend stocks?

Yes, you should.

Should I sell my dividend stocks because they won’t outperform?

No, this is not what we’re saying. Great companies often pay dividends. The dividend is incidental to the reasons they go on to outperform, not the actual cause.

Are dividends good?

Yes, they are. Historically, dividends have represented a large portion of the total return from the stock market. Every healthy portfolio of equities has a dividend component to it.

Is the higher tax on dividends an insurmountable hurdle vs the returns from share buybacks?

Most companies paying a dividend are also engaging in share buybacks and the best returns come as a consequence of focusing on shareholder yield and total return (dividends + buybacks + price gains - think Apple).

Are companies that don’t pay dividends inherently bad investments?

Tesla doesn’t pay dividends. Nvidia just started to after a 10,000% return. Berkshire Hathaway, the greatest stock of all time, has never and potentially will never pay a dividend. A portfolio without Tesla, Nvidia and Berkshire Hathaway has not done as well as a portfolio with them over the past fifteen years. These are among the best stocks with the highest returns you will have ever seen for the rest of your investing career. You could go the next thirty years without another Nvidia coming along ever again. Dividend-only investors could only look on and shit-talk the stock. I appear regularly on TV with these people. It’s remarkable how myopic even a professional investor can be when they have chained themselves to an exclusionary mandate. Run far away when people have to force themselves to deliberately not understand something because they’ve painted themselves into a rhetorical corner.

What about dividend growth as opposed to high dividend?

Yes, I like this better, but I still wouldn’t use this idea to the exclusion of owning other stocks. Dividend growth strategies will include companies with lower but growing payouts and will often end up with holdings that have a better future price upside.

What about a sleeve of my portfolio focused on high dividends?

Sure. Why not. Just don’t expect this sleeve to outperform market-cap weighting over time. But if it makes you happy, go for it.

How do you feel about yield targeting?

There are managers who say “We need to earn 4% or 5% from a stock dividend for me to even consider including the stock in my holdings.” I admire their discipline while making sure to avoid giving them any of my capital to invest. These are garage people. I don’t care about garages, I want the best houses and very often the best houses will include great garages.

Should I create my own dividend by selling covered calls against the stocks I own?

You can certainly do this or find a fund manager who does this for you. This is known as a buy-write strategy and is utilized to generate income higher than what the actual dividends will provide. But the income from options premiums is not dividend income. And when you sell a covered call, there is a risk of having the stock you own called away at a price lower than where it is currently trading at. This adds an entirely new dimension of risk to your equity market exposure that we’re not going to get into today.

Are dividends better or worse than the interest payments I get from bonds?

No, just different for a variety of reasons we are not going to cover today either. The only thing I want to say on this is don’t think about bond interest and dividend yield as being interchangeable. Both are features of a well balanced portfolio and they may look functionally the same when the payments hit your account, but they are entirely different sources of return with distinct risk profiles and volatility characteristics.

Anything else?

There’s a such thing as dividend quality. Some managers screen for this. They want to understand the source of dividends and whether or not the stated current payout is sustainable given the business’s balance sheet and cash flow. To me, this is a similar idea to focusing on the quality factor. Quality is good, although a screen emphasizing it is going to cause you to miss a lot of non-payers or companies that are more focused on innovation than providing current income to shareholders. You don’t want to miss these.

I hope this has been informative and will keep you from making the dividend-obsession mistake that has caused massive underperformance for both pros and amateur investors alike over the last few decades.

Why Brian Wesbury is bearish this year

There’s a funny moment in this week’s The Compound and Friends episode where Brian Wesbury is confronted by someone who is mad that he is a perma-bull who has become a perma-bear. “Repeat that sentence back to yourself” he quips. If you’re a perma-anything, definitionally, you cannot switch. Brian has been bullish for as long as I’ve been reading his notes (and that’s a long time) until recently. He’s pessimistic on stock market returns for the coming year and he’s got an interesting reason as to why.

I want to make sure you don’t miss this conversation, even if you disagree with his outlook. Brian is not a doomer or a sensationalist, he just differs from the current Wall Street consensus based on his model for what fair value ought to be for the S&P 500. He may be early, he may be wrong. That’s what makes a market.

Listen on the podcast app of your choice or watch it on YouTube:

The State of The Compound

Speaking of The Compound and Friends, I wanted to share some data with you about the channel and the shows we’ve done this year.

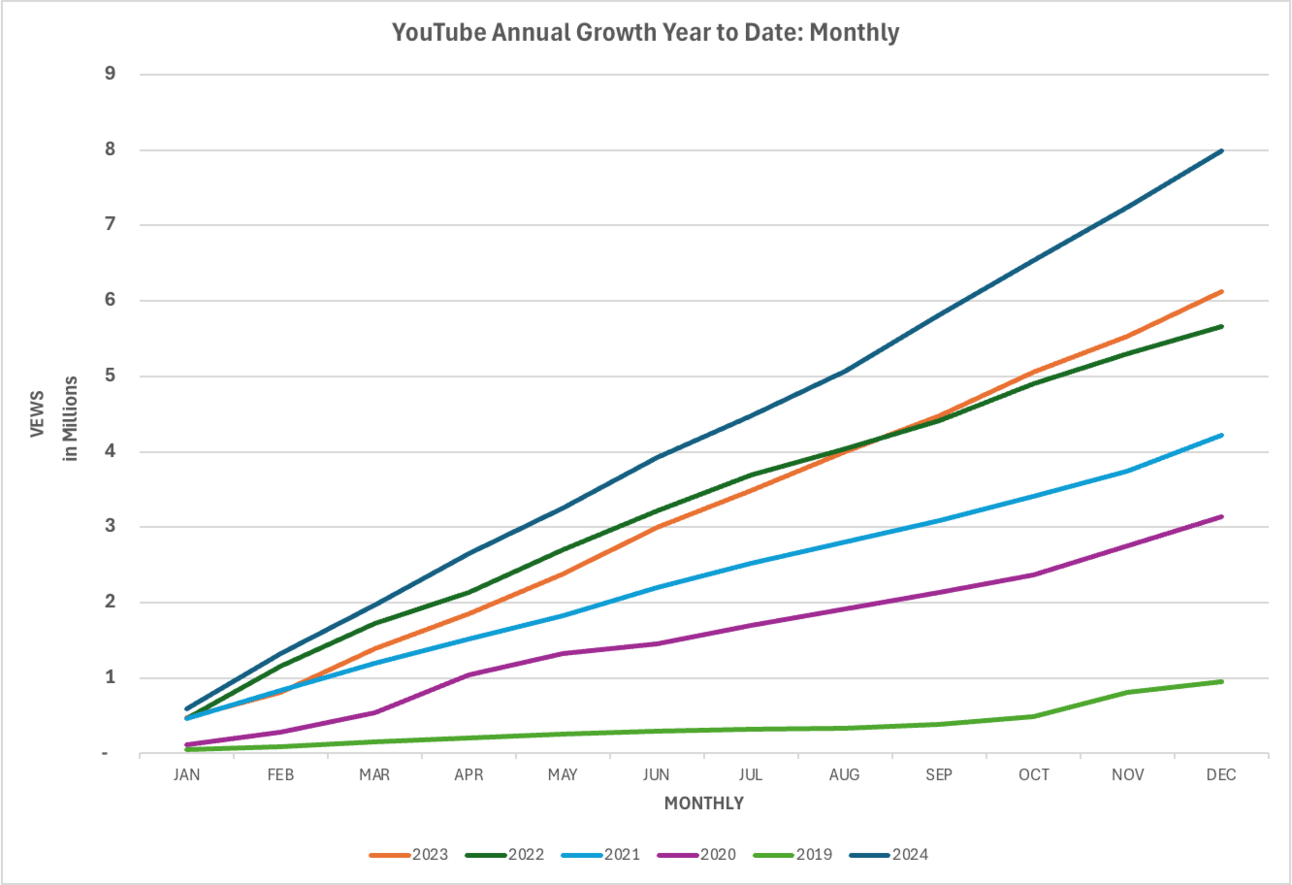

First things first, this has been a year of explosive growth for us on YouTube and that’s all thanks to you making our stuff a regular part of your life. In 2024, our views have skyrocketed faster than during any previous year:

That’s 8 million views for the channel by year end, eclipsing the prior year’s total of 6 million views and setting quite a bar for 2025 (because if you know anything about me, you know I’ll never be satisfied and my belief in our potential is both absolute and unwavering).

According to the data collected by Rob Passarella, who runs our media business, The Compound’s listenership and viewership has taken off like a rocket this past year:

Audio podcasts: 8,028,019 listens

Video on Compound YouTube: 8,001,382 views, 30% growth YoY

16,029,401 combined listens/views

We added 33,400 subs this year on YouTube 24% growth YoY

Taking a look at the written stuff we’re doing on this blog and all the others, it’s the same story:

The Compound Insider: https://www.thecompoundnews.com/ email blast started 2024 with 952 subs, ended with 6,718 subs - a 600% growth rate with an email open rate of 70%. The Unlock https://www.advisorunlock.com/, our advisor only email blast, started 2024 with 0 and ended with 2,801 verified advisor subscribers with an open rate of 60%.

My site, Downtown Josh Brown, started 2024 with 20,944 subs ended with 24,600, which is 17% growth and an open rate of 65%. This was accompanied by strong readership and open rates for Michael Batnick’s blog, Ben Carlson’s blog, Callie Cox’s brand new blog, Nick Maggiulli’s blog, Barry’s site and all the others. We are writing and you are reading. Most importantly, everyone is getting smarter and gaining more knowledge with every passing day.

I ask you, what could be better?

If you’re a fan of our stuff and it’s helping you with your investments and understanding of the markets, then we’re doing our jobs. The amount of personal satisfaction we get as a result of this relationship we have with you is literally immeasurable. I hope you feel the same.

Okay, that’s all I have for you today. Wishing you a wonderful weekend and a Happy New Year! Talk soon! - JB