I gave a talk to an audience of global retail brokerage leaders from around the world at the Nasdaq’s headquarters in New York City the other day and I used the opportunity to demonstrate how the last 25 years have been more of a revolution than an evolution.

I got my Series 7 license to sell securities in 1997 when I was 20 years old. In the time since, I’ve had a front row seat for some of the biggest shifts and innovations in the history of the stock market. The acceleration of change has been blistering relative to previous eras and the pace doesn’t seem to want to stop. In the below deck, I take you through the last quarter century and then make some predictions about what we’ll see in the near future, including tokenizing real estate / farmland / buildings and infrastructure, collectibles as an asset class held in brokerage accounts, the convergence of digital assets and traditional stocks and bonds, the onset of 24/5 and then, perhaps, 24/7 trading and more.

I also have a section where I draw the distinction between millennials and Gen Z - two very different cohorts of investors. The millennials (or Gen Y) tiptoed into the stock market very slowly after witnessing their parents’ portfolios get cut in half twice within a seven year period (2002-2009) during the twin crises of the aught’s decade. For years there was an open question about whether or not Gen Y would ever embrace stocks the way prior generations had. Gen Z, on the other hand, kicked down the door in 2020 and began their era of investing fearlessly. They bet big, look for non-traditional opportunities and treat trading like a video game that can be beat. They’re also exhibitionists about big losses and seem to have a much better sense of humor about their own fails. There’s a real distinction between these two generations.

I’ll throw some of my speaking notes from the talk I gave in between some of these so you’ll have a better idea of what I’m talking about. Huge thanks to Sean Russo and “Chart Kid” Matt Cerminaro from my research team for helping me put this all together.

Thanks to Nasdaq for having me there!

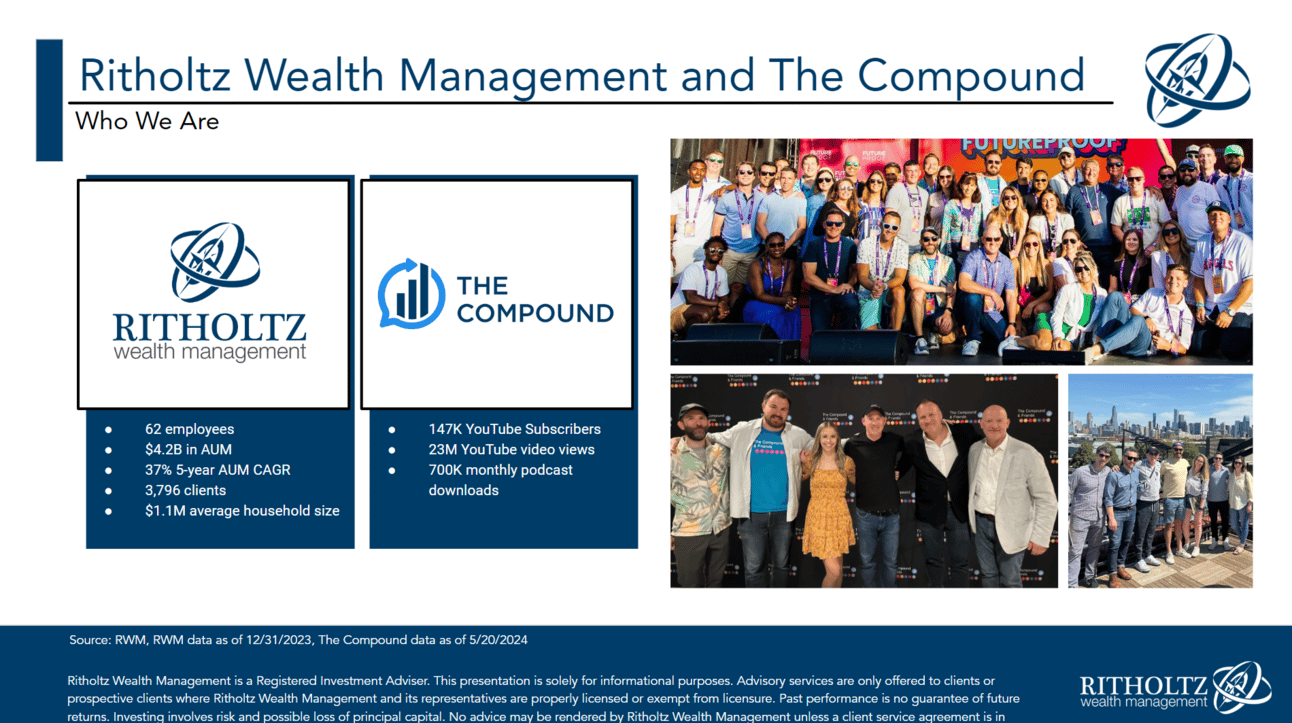

For those of you who don’t me, I am an on-air contributor to CNBC, a blogger, podcaster and in my day job I am the founder and CEO of a wealth management firm called Ritholtz Wealth Management, with more than 4,000 client households and over $4 billion in assets under management.

We reach millions of investors and traders on social media and our popular podcast The Compound and Friends. We also host an annual wealth management industry festival in Huntington Beach, California every September. This year we’re expecting between 4 and 5,000 industry professionals from financial advisors to fintech executives to asset managers. The panels and networking are essential and the parties are lit AF, as the kids say.

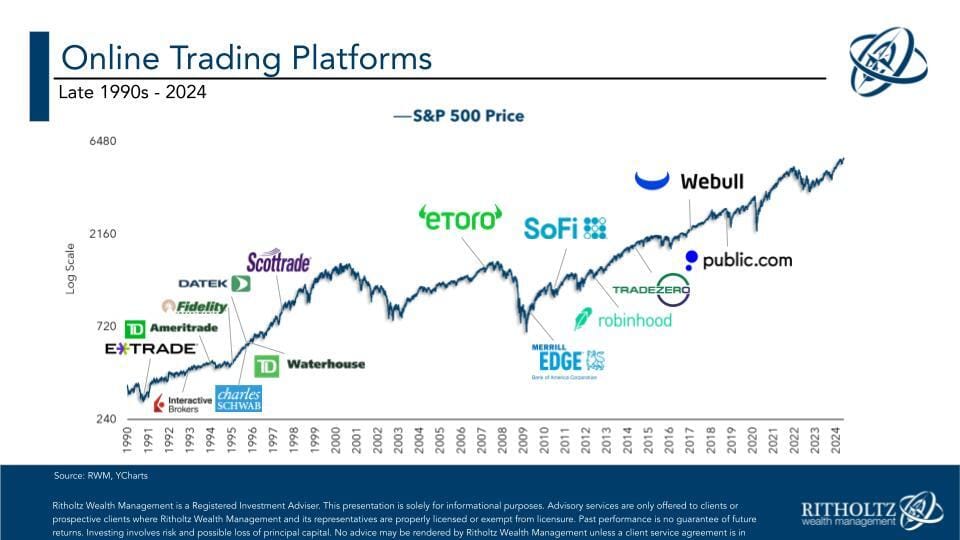

In 1989, roughly a quarter of US households had investments in the stock market, mostly through mutual funds. By 1999, that number jumped to half of all households or about 48 million.

And since then, we’ve watched as investors went from placing trades on a desktop computer to using laptops and then eventually apps on their phones. Trading got faster, cheaper, more efficient and easier for people who had never been exposed to the stock market before. Trading is now a mainstream activity among Americans of all ages, all educational backgrounds, genders, ethnicities and vocations. Virtually anyone who wants to get involved can get involved. We take this trend for granted but it’s truly a different world today from 25 years ago.

A generation later and it was the millennials’ turn to start investing. This generation had watched their parents’s portfolios get cut in half twice during their adolescence - first in 2000- 2002 during the dot com meltdown and then again five years later from 2007 to 2009. This was a generation that graduated from college into a labor force that had been rocked by the Great Financial Crisis. This delayed their ability to move away from home and form households of their own. It also kept them from falling in love with the stock market the way their Boomer parents and Gen X older brothers and sisters had. For a while there was an open question about whether or not millennials in America would ever become investors outside of their 401(k)s at work.

In the wake of the financial crisis, a new innovation came along that offered advice for this generation so they wouldn’t have to begin their portfolios alone. Traditional Wall Street firms had no interest in serving millennials with less than $100,000 in liquid assets. The only financial advisors who were interested in helping them were insurance company advisors who wanted to sell them annuities or independent broker-dealers who wanted to sell them high-cost, front-loaded mutual funds. There was no good wealth management solution for the millennials until the concept of robo-advice came along.

Now, you could put $20,000 into an account, answer a couple of questions to establish your time horizon and risk tolerance and the software would recommend a diversified portfolio, automatically rebalance it and handle the withdrawals directly from a bank account. This was the solution that brought gun-shy millennials off the sidelines and taught them about asset allocation and retirement planning. Today, many human-driven advisory firms, like mine, are using these robo-asset allocations tools to serve clients we historically would not have time for.

In 2015, my firm launched Liftoff which is built on Betterment’s platform and to this day we serve investors with up to $250,000 on that platform. Last summer we acquired Future Advisor from BlackRock, transitioning all of its clients over to a purpose-built online platform that allows us give them human advice combined with automated account management. This service tier, which ranges from $250,000 up to $1 million is called Good Advice and it will be the source of our next generation of wealth management clients as their lives grow more complex, their portfolio values increase and they ask us for more and more services. We custody Good Advice at Schwab and Fidelity. AdvisorEngine is the company that helped us build our platform.

The next generation after the millennials is Gen Z and Gen Z is very different. They like taking risk. They see markets like a video game that can be beaten, or a puzzle that can be solved. They’re young enough to want to experiment and bold enough to embrace the volatility of the market, attempting to make it work in their favor rather than shying away from it. Most importantly, they see trading and investing as a social activity. They want to show their friends what they’re doing and share their strategies with their peers around the world. This makes perfect sense when you think about it. This is the generation that grew up sharing their location, pictures of their food and videos of themselves dancing.

Meme trading is one obvious example of this willingness to experiment and their love of the action.

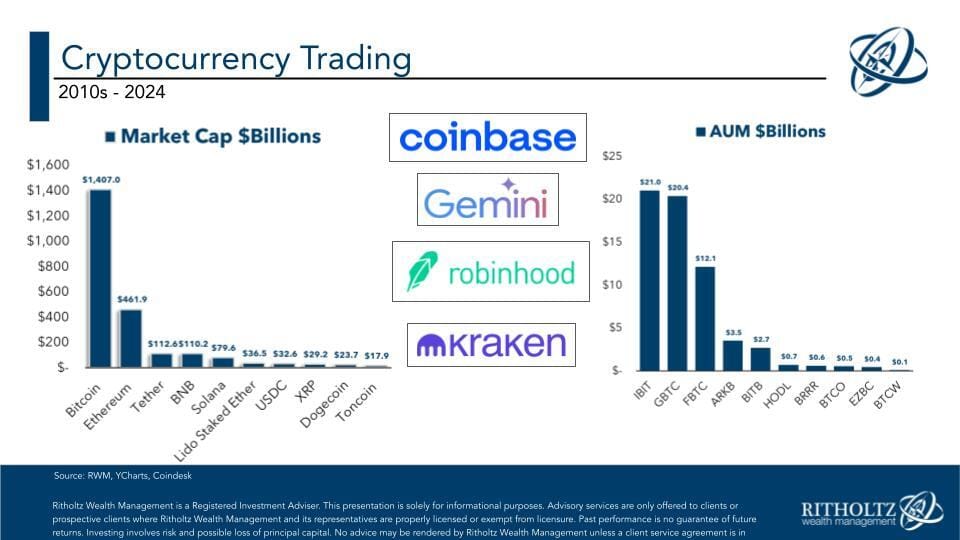

The attraction to crypto and digital assets is another example.

55% of U.S. Gen Z investors aged 18 and over primarily invest in cryptocurrency - meaning they’re buying more Bitcoin than they’re buying stocks (CFA Institute).

20% of Gen Z respondents (ages 18-26) in the PolicyGenius survey own cryptocurrency.

22% of Gen Z respondents in The Motley Fool study reported owning cryptocurrency.

As of June 5th, 2024 total crypto trading volume within a 24hr period was at $98B, this figure peaked in May of 2021 at $524B (Bitcoin price peaked 6mo later in Nov 2021)

2023 24hr trading volume in crypto was 33% lower in 2023 vs 2022

As of June 5th, BTC represents 50% of global crypto market cap, with ETH in second place at just 16%

One thing I’ve noticed about Generation Z investors is that they view stocks and crypto interchangeably. They don’t recognize any distinction between a coin and a stock. They don’t understand why the two things would be segregated, or why one trades between 9:30am and the other trades 24 hours a day, 7 days a week.

This is probably why Robinhood has surpassed $20B in overnight trading volume since launching Robinhood 24hr Market last year

To the typical Robinhood customer, stocks should be as accessible as crypto. I am guessing that most of you believe we will see 24/5 stock markets go mainstream within our lifetime and possibly even 24/7 at some point in the future. It’s Gen Z that will drive this trend as their buying power increases and they begin to take executive roles around the industry.

As a financial advisor, this is terrifying to me. It’s hard enough holding clients' hands five days a week through breaking news and volatility.

Turning collectibles into tradable assets is another way in which the markets have changed. Enabling people to buy and sell historical artifacts, baseball cards, classic cars, music and sports memorabilia, cases of wine, famous works of art and more has led to people thinking bigger about what it means to be an investor. I can envision a day when these types of assets are assigned something like a CUSIP so they can sit alongside stocks, bonds and funds in a brokerage account giving investors a complete and holistic view of their portfolios.

Needless to say, this was an explosive development for investors and advisors of all generations. Commission-free stock and ETF trading has opened up a whole new world of possibilities now that it has been embraced - even if reluctantly by some of the firms in this room.

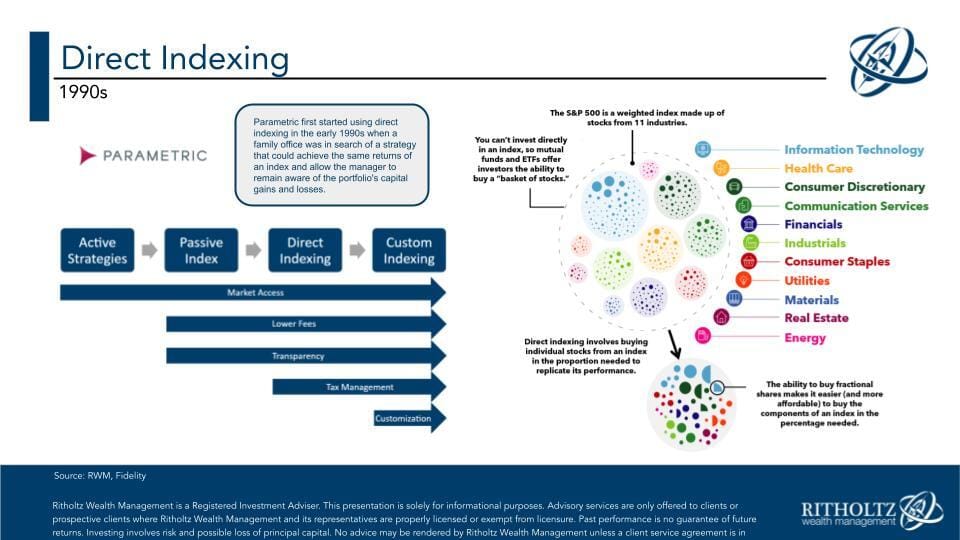

The biggest wave in the investment business now is direct indexing - the ability to give clients exposure to the market outside of a fund wrapper and exert more control of the individual components themselves. Prior to commission-free trading, we would not have been able to do this in a cost-efficient way for our clients. We would have had to shift these accounts to asset-based pricing and away from paying $5 per trade. You can’t effect thousands of trades for a client at five dollars a pop and still live up to your fiduciary obligations. When stock trading became free, direct indexing proliferated throughout the advice space. That would not have happened otherwise.

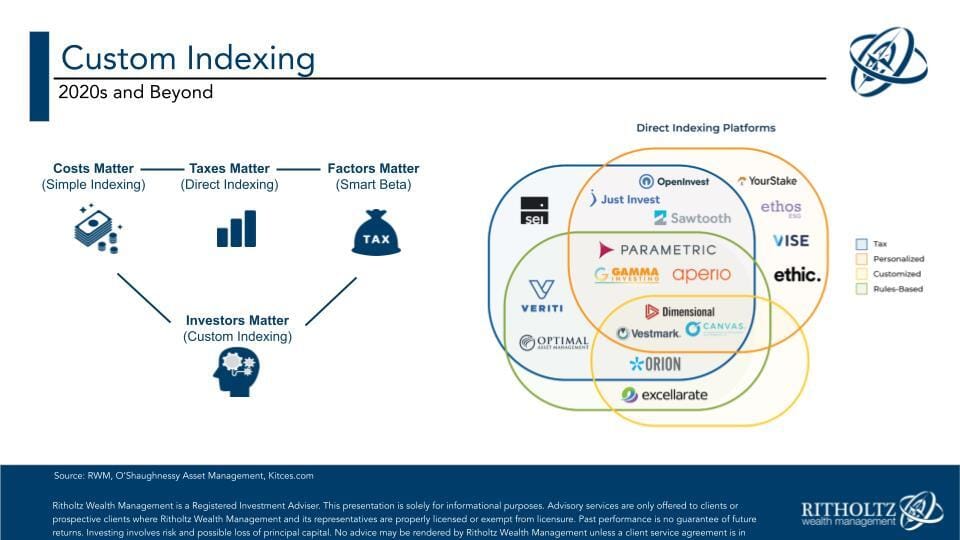

Some real-life examples of the power of custom-indexing:

An oil company employee had a 50%+ concentration in his own company’s stock, we were able to restrict the entire O&G industry and tax loss harvest the rest to de-concentrate his portfolio and generate tax write-off opportunities

A client sold a medium-sized private business, we DCA’d into the market and maxed-out loss-harvesting efforts to offset as many gains from the business sale as possible, while still generating positive returns for the portfolio

A Mag 7 company tech employee was able to tax-loss harvest out of a 50%+ equity concentration

With custom indexing, my firm can remove stocks or industries that clients don’t want their money invested in but still target the performance of the index. We can be tax-sensitive and we can over-or-underweight themes, sectors and exposures using automation that allows us to do so at scale.

We have become better at our jobs as a result. In my opinion, advisors who have embraced custom indexing tools are leapfrogging ahead of the rest of the industry.

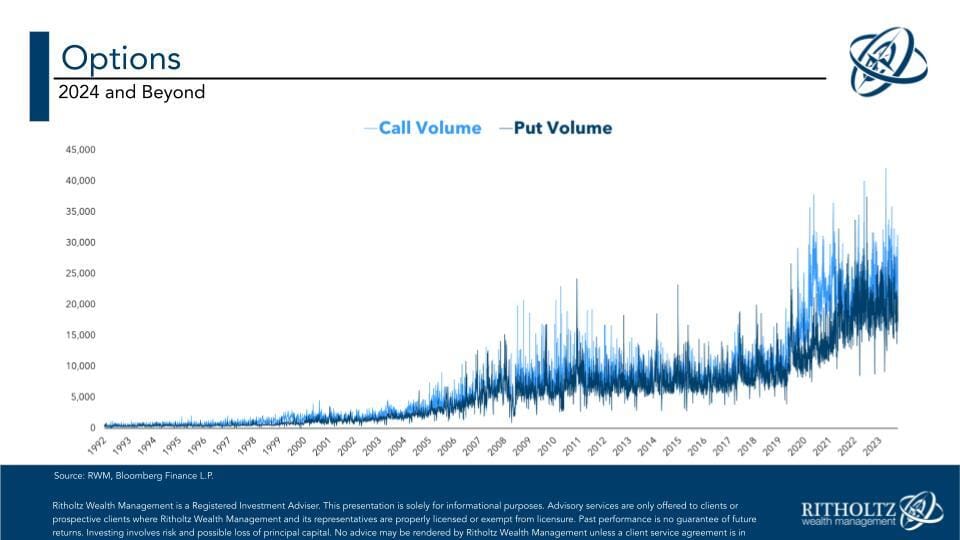

The explosion in popularity that the options market has seen is yet another revolution you have brought about. Some investors use options to reduce risk, like covered call selling, but that’s no fun. Investors use options to increase their bets, or attempt to control the risk/reward situation on their trades.

Chart: From 92’ - 23’ the CAGR for call volume is 12% and the CAGR for Put volume is 13% (for comparison, the S&P 500 has a CAGR of 8% during the same time period)

Retail options trading has grown 10x the past decade, going from $20B in 2010 to about $240B in 2020

In November of 2019, zero or one-day-to-expiration options were 12% of volume, this hit 22% in Q4 of 2023

Via CBOE: 49% of SPX volume is 0DTE (0 days til expiration)

There’s been a 52% annual increase in SPX 0DTE volume since 2016

Total volume of trading reached 137B contracts globally in 2023, up 64% YoY

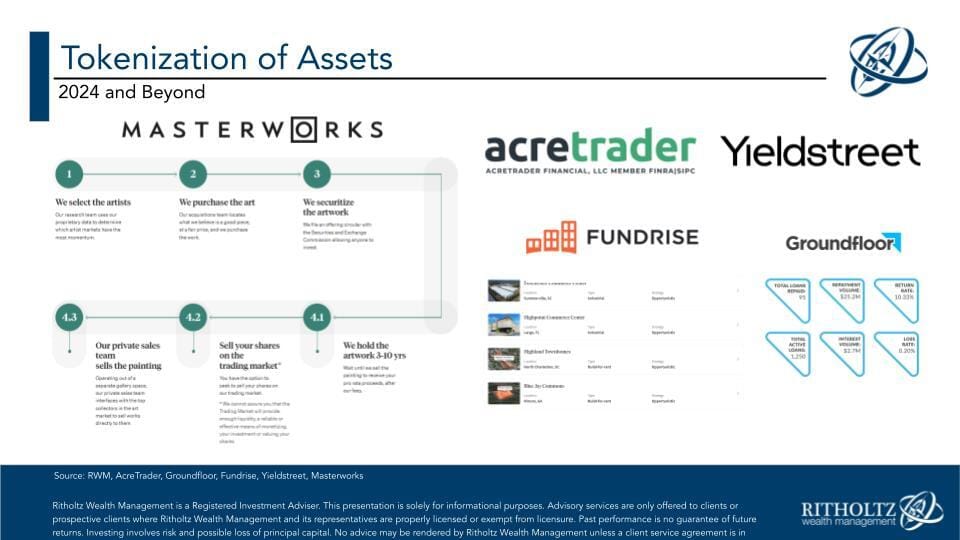

BlackRock thinks $10T of on-chain and real-world assets will be tokenized.

Today, if a retail investor wants to invest in a skyscraper in Manhattan, they have to buy shares in a REIT. Tomorrow, they might be able to buy fractionalized shares or tokens representing a piece of that building. Or a toll road. Or a bridge. Or a sports stadium. They’re already able to buy a piece of a Ferrari, so why not a piece of land or a building?

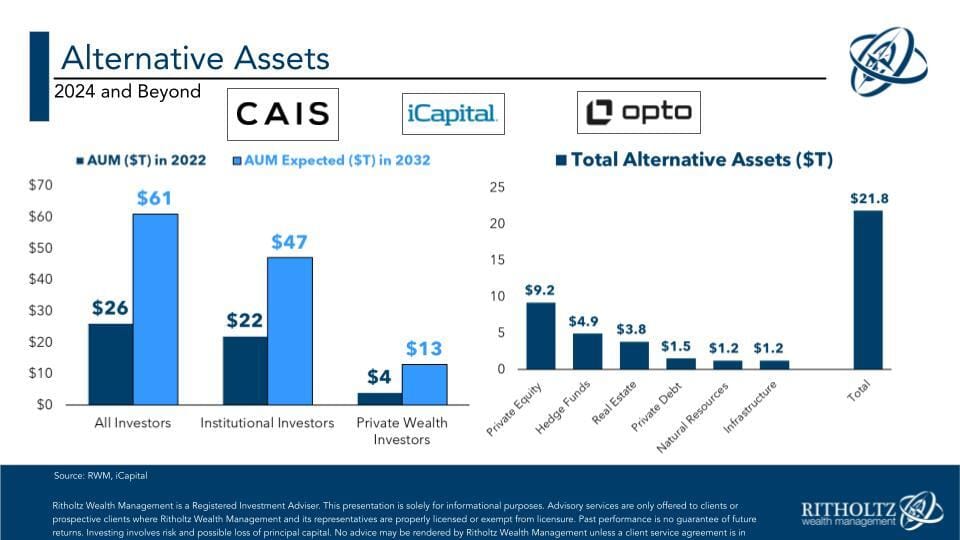

Out of total investable assets, alts hit a record 15.5% of assets in 2022, but fell down to 14.9% in 2023.

US Private Credit AUM has grown from $40B in 2000 to $1.2T in Q4 of 2023. Private Credit AUM has more than doubled since 2019.

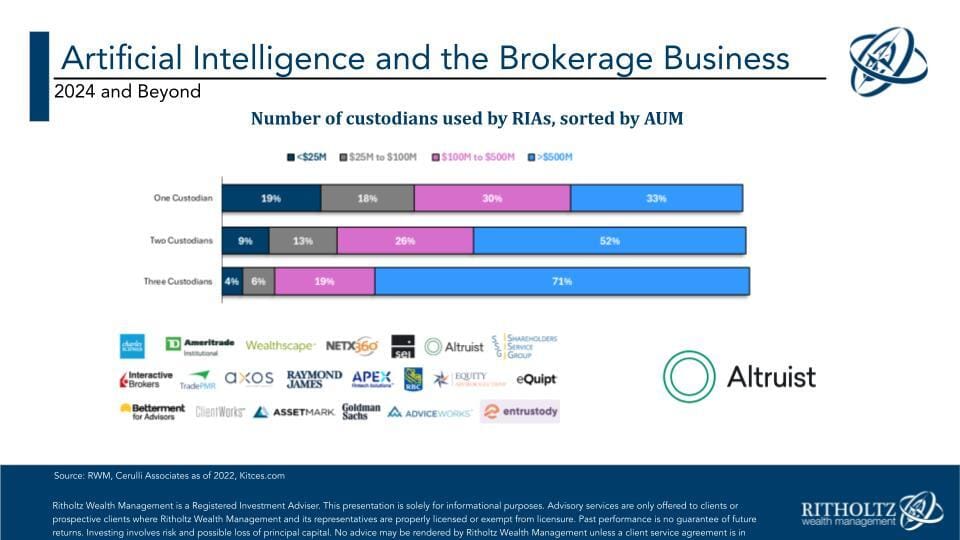

Too early! I didn’t have a lot to say on AI in retail or advisor-directed brokerage accounts but my assumption is that every custodian / broker on this slide is working on incorporating these tools and by this time next year, there will be plenty to say. Altruist gets a special call-out here because they are defining the category of next-gen custody solutions for advisors and seem to the most technology-forward platform in our space right now.

RBC’s Lori Calvasina joins The Compound and Friends!

Lori was awesome on the show, as expected

Let me just start by saying - Lori Calvasina is awesome. She gets huge props and respect from her fellow chartists and strategists all over Wall Street. The sheer amount of charts she publishes on a regular basis is mind-blowing. And she is evidence-based to the core - rather than come up with a story and then hunt down the charts that support it, she prefers to let the data speak and then firms up her conclusions about what’s happening afterwards. She’s a real pro’s pro and we were so happy to have her on the show for the first time.

Charts for days

You can watch the full episode below or hit this link to listen on your favorite podcast app.

The Book!

Thanks for all the love and support and excitement around my new book. When we announced it last week without getting into any detail, the expectation was that a few people might pre-order, given the fact that it’s not coming out until September. But actually, it went to number one in its category and that’s all because of you.

I can’t tell you how much I appreciate that. This is my most personal book of the four I have written. I can’t wait for you to read it and tell me what you think.

Pre-orders are now available everywhere. Hit this link to reserve your copy now!